Ringgit Opens Slightly Higher Against US Dollar Ahead of Key Inflation Data

November 13, 2024 at 4:00 PM

2 minutes read

KUALA LUMPUR: The Malaysian ringgit opened marginally higher against the U.S. dollar on Wednesday, trading at 4.4330/4465 compared to Tuesday’s close of 4.4365/4400. This slight gain came despite the U.S. Dollar Index (DXY) strengthening, typically a signal of higher demand for the dollar.

Bank Muamalat Malaysia Bhd’s chief economist, Dr. Mohd Afzanizam Abdul Rashid, noted that demand for the greenback is expected to rise as U.S. Federal Reserve officials indicated that future interest rate cuts would be data-dependent. “Minneapolis Fed President Neel Kashkari suggested that he will assess the upcoming inflation data before making any rate decision,” said Dr. Afzanizam. This approach may keep the ringgit and other emerging market currencies under pressure in the near term.

Investors are closely watching the latest U.S. Consumer Price Index (CPI) report, due to be released tonight. Expectations are for a 2.6% increase in October, up from 2.4% in the previous month, with Core CPI forecasted to hold steady at 3.3%.

The ringgit also traded higher against a range of major and regional currencies this morning. It strengthened against the British pound at 5.6463/6635 from 5.6889/6934 and gained against the euro, trading at 4.7061/7204 from 4.7111/7148. It rose against the Japanese yen to 2.8661/8752 from 2.8788/8812 at Tuesday’s close.

Among ASEAN currencies, the ringgit made gains, trading higher against the Thai baht at 12.7162/7637 from 12.7456/7608 and strengthening against the Singapore dollar at 3.3107/3210 from 3.3143/3174. The local currency also rose slightly against the Philippine peso at 7.53/7.56 from 7.54/7.55 and gained on the Indonesian rupiah at 280.8/281.9 from 281.0/281.5.

Up next

Barclays Reshuffles APAC Investment Banking Leadership to Boost Regional Presence

July 3, 2025

3 minutes read

Elon Musk Faces Backlash Over Comments Targeting Government Employees

November 27, 2024

2 minutes read

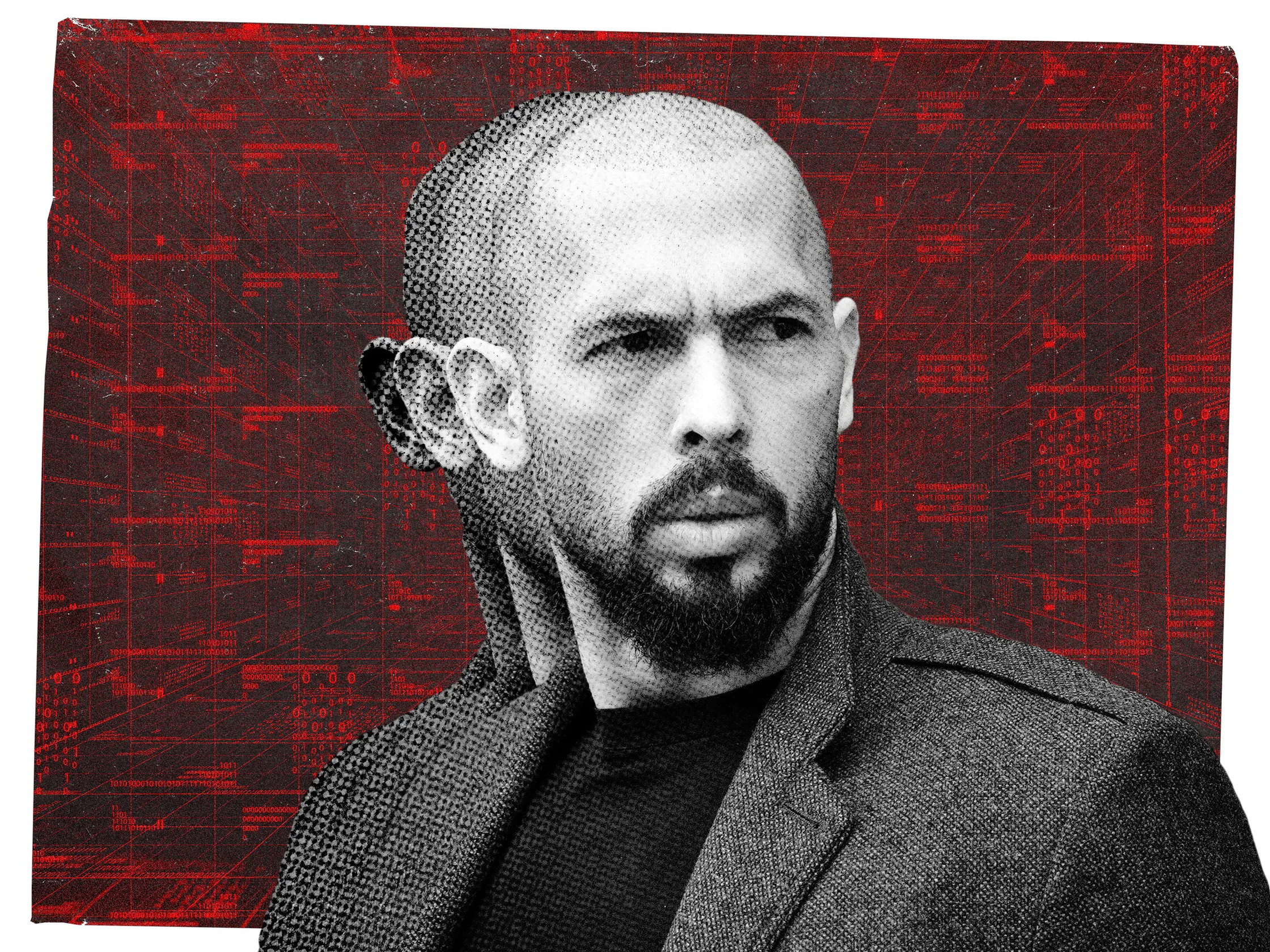

Major Cybersecurity Concerns Highlighted in Andrew Tate Hack and Undersea Cable Incident

November 25, 2024

2 minutes read

DirecTV and Dish Network Merger Cancelled Amid Regulatory and Financial Challenges

November 22, 2024

2 minutes read

Deportation Concerns Loom Over U.S. Labor Market Amid Worker Shortages

November 21, 2024

2 minutes read

Comcast Explores Spinoff of NBCUniversal's Cable Division Amid Industry Changes

November 20, 2024

2 minutes read

Economic Concerns Arise Over Trump’s Deportation Plan Amid Grocery Price Inflation

November 19, 2024

2 minutes read

China Challenges Western Duopoly in Civil Aviation with C919 Aircraft Launch

November 17, 2024

2 minutes read

Disney’s Earnings Offer Hope for Streaming Amid Decline of Traditional TV

November 15, 2024

2 minutes read

Bluesky's User Base Doubles as Users Flee X Amid Trump Influence and Content Shifts

November 14, 2024

2 minutes read

7-Eleven Owner Considers Historic $58 Billion Buyout to Go Private in Japan

November 13, 2024

2 minutes read

U.S. Regulators Investigate Engine Failures in 1.4 Million Honda Vehicles

November 12, 2024

1 minutes read

Woman Discovers Forgotten Lottery Ticket in Her Purse, Wins $1 Million

November 11, 2024

2 minutes read

How ReelShort CEO Joey Jia Used a Chinese Trend to Disrupt the U.S. Entertainment Industry

November 11, 2024

8 minutes read