Car Dealers in China’s Yangtze Delta Region Warn of ‘Severe Challenges’

June 30, 2025 at 6:08 AM

3 minutes read

A coalition of four influential dealer associations in China’s Yangtze River Delta—spanning Shanghai, Jiangsu, Zhejiang, and Anhui—has raised the alarm over what it calls “severe challenges” facing the industry. In a joint WeChat letter to automakers, they highlighted three urgent issues:

- Excessively high inventories—dealerships are flooded with unsold cars, elevating storage costs and tying up working capital.

- Price wars cutting dangerously low—some manufacturers are reportedly pushing dealers to sell at or below cost, echoing regulators' concerns of anti-competitive behavior.

- Suspended consumer financing—banks have paused car loans since June, silencing buyers and locking up further sales revenue. :contentReference[oaicite:0]{index=0}

🚨 Regional and national fallout

This is not an isolated incident. Similar letters have emerged from Henan and Jiangsu provinces as dealers and suppliers nationwide push back. With the delta region accounting for nearly a quarter of China’s new vehicle market, the plea carries considerable weight. The associations warned that persistent below-cost selling and an unchecked price war could threaten dealers’ financial solvency. :contentReference[oaicite:1]{index=1}

📈 Regulatory backdrop

To address the turmoil, Chinese lawmakers approved amendments to the Anti-Unfair Competition Law, prohibiting forced below-cost pricing starting October 2025. Dealers argue this change is needed sooner, alongside practical measures like inventory caps and realistic sales targets. :contentReference[oaicite:2]{index=2}

🔄 What happens next

Dealership groups want a seat at the table—proposing that automakers collaborate on setting inventory limits and targets that better reflect actual demand. Both manufacturers and regulators may now face choices: rethink aggressive discount strategies, enforce new rules, or risk dealer bankruptcies.

Key takeaway:

China’s car retail sector is at a tipping point. Dealers are calling on automakers to rethink deep discounting and inventory misalignment, while lawmakers stiffen regulations. The outcome could reset pricing norms and supply-demand balance in the world’s largest auto market.

Up next

Barclays Reshuffles APAC Investment Banking Leadership to Boost Regional Presence

July 3, 2025

3 minutes read

Elon Musk Faces Backlash Over Comments Targeting Government Employees

November 27, 2024

2 minutes read

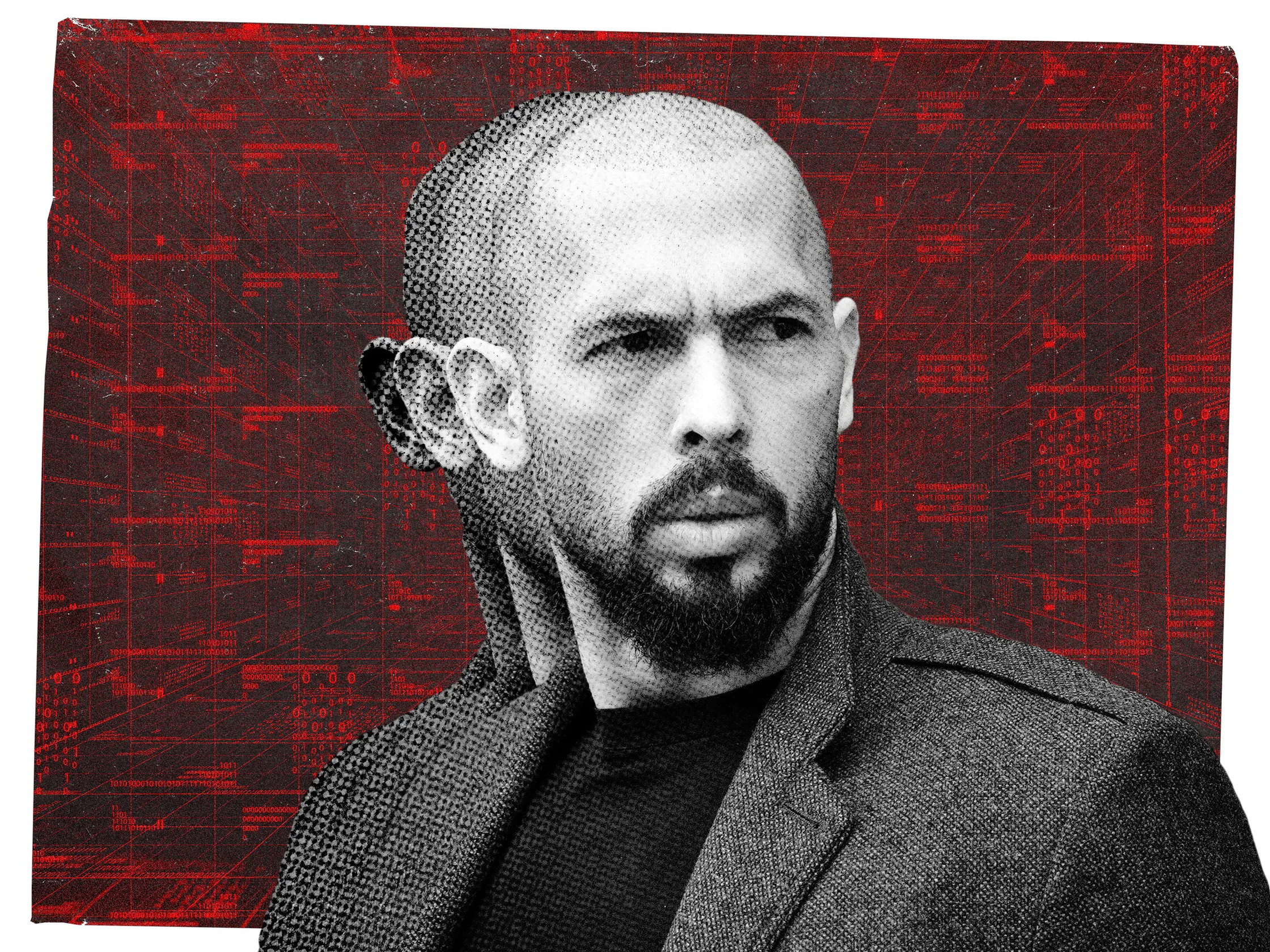

Major Cybersecurity Concerns Highlighted in Andrew Tate Hack and Undersea Cable Incident

November 25, 2024

2 minutes read

DirecTV and Dish Network Merger Cancelled Amid Regulatory and Financial Challenges

November 22, 2024

2 minutes read

Deportation Concerns Loom Over U.S. Labor Market Amid Worker Shortages

November 21, 2024

2 minutes read

Comcast Explores Spinoff of NBCUniversal's Cable Division Amid Industry Changes

November 20, 2024

2 minutes read

Economic Concerns Arise Over Trump’s Deportation Plan Amid Grocery Price Inflation

November 19, 2024

2 minutes read

China Challenges Western Duopoly in Civil Aviation with C919 Aircraft Launch

November 17, 2024

2 minutes read

Disney’s Earnings Offer Hope for Streaming Amid Decline of Traditional TV

November 15, 2024

2 minutes read

Bluesky's User Base Doubles as Users Flee X Amid Trump Influence and Content Shifts

November 14, 2024

2 minutes read

Ringgit Opens Slightly Higher Against US Dollar Ahead of Key Inflation Data

November 13, 2024

2 minutes read

7-Eleven Owner Considers Historic $58 Billion Buyout to Go Private in Japan

November 13, 2024

2 minutes read

U.S. Regulators Investigate Engine Failures in 1.4 Million Honda Vehicles

November 12, 2024

1 minutes read

Woman Discovers Forgotten Lottery Ticket in Her Purse, Wins $1 Million

November 11, 2024

2 minutes read

How ReelShort CEO Joey Jia Used a Chinese Trend to Disrupt the U.S. Entertainment Industry

November 11, 2024

8 minutes read