US Stock Market Faces Challenges Amid Trump-Fueled Rally

November 18, 2024 at 5:00 PM

2 minutes read

The US stock market, which has experienced a surge in recent weeks fueled by optimism tied to Donald Trump’s political momentum and economic vision, is now facing mounting challenges. Investors are grappling with a mix of economic uncertainty and global tensions, which threaten to dampen the rally.

The initial boost in equities came as Trump’s campaign emphasized deregulation, tax cuts, and business-friendly policies that many believe could reignite growth in key sectors. This optimism was particularly evident in technology and energy stocks, which saw substantial gains as investors bet on a favorable business environment under a potential Trump presidency.

However, recent developments have introduced headwinds that are causing some to question the sustainability of this rally. Concerns over inflation remain at the forefront, with the Federal Reserve signaling a cautious approach to interest rate cuts. Higher borrowing costs continue to weigh on corporate earnings and consumer spending, key drivers of market performance.

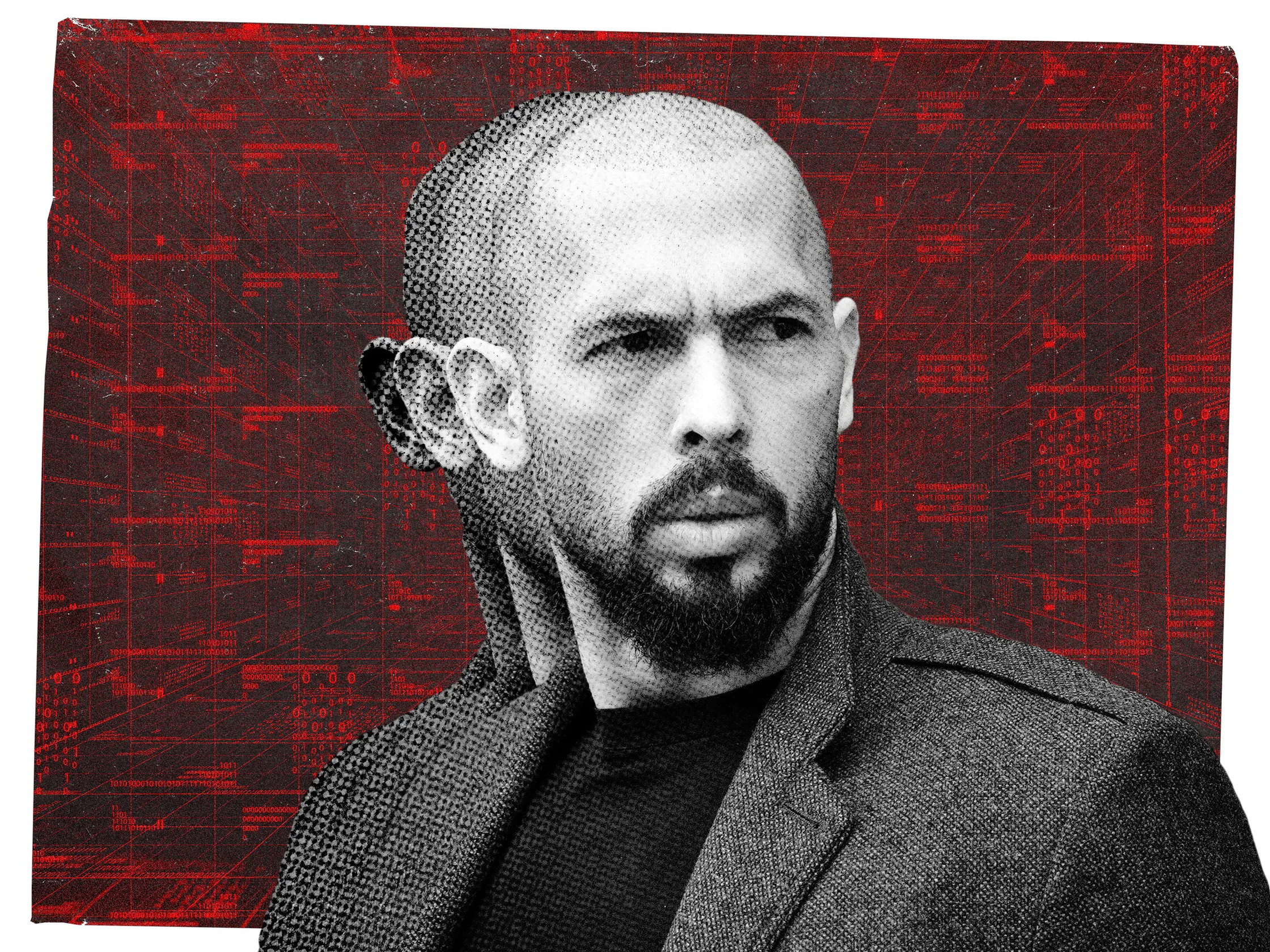

Geopolitical ten--- title: "How ReelShort CEO Joey Jia Used a Chinese Trend to Disrupt the U.S. Entertainment Industry" date: "2024-11-11T14:10:00" featured: true category: "Business" image: "/how-reelshort-ceo-joey-jia-used-chinese-trend-disrupt-us-entertainment-industry.webp" imageDescription: "Joey Jia speaks during the Crazy Maple Studio and Screencraft Celebration of the Launch of Their Screenwriting Competition at NeueHouse Hollywood on October 11, 2024 in Hollywood, California." imageSource: "Getty Images for Crazy Maple Stu—2024 Getty Images" description: "" duration: "8 minutes read"

The plot of “The Double Life of My Billionaire Husband” unfolds in just over 90 seconds, yet captivates audiences with its drama-packed storyline. A young woman, desperate to pay for her mother’s kidney treatment, begs her father and cruel stepmother for $50,000. Her stepsister smugly proposes a solution: marry the outcast son of a wealthy family. Faced with few options, the protagonist reluctantly agrees.

This micro-drama, which airs on the ReelShort app, has amassed over 419 million views, outshining the first season of Netflix’s Squid Game, which had 265 million views. ReelShort’s popularity stems from the rising demand for “micro-dramas” in China—a trend that Joey Jia, CEO of Crazy Maple Studio, has successfully introduced to the U.S. market. Jia believes that short-form, vertical video content is the future of entertainment.

“Amid the rise of short-form videos on platforms like TikTok and Douyin, I saw an opportunity to bring bite-sized dramas to the U.S.,” says Jia. “The global appetite for engaging, seconds-long stories is growing rapidly.”

A New Approach to Content Creation

Jia’s journey began with Crazy Maple Studio’s visual novel platform, Chapters, but he soon realized that the short-form content model was taking off in China. Inspired by influencers creating mini-dramas on platforms like Douyin, Jia decided to bring this format to Hollywood. When traditional media channels were reluctant to distribute low-budget, short-form dramas, Jia launched ReelShort to bring the concept to American audiences.ReelShort specializes in genres like billionaire romances, werewolves, and revenge plots—genres proven to capture viewers' attention quickly. “Our stories are crafted to grab attention immediately,” Jia explains. “Once viewers start watching, they’re compelled to keep going.”

Low-Budget, High-Impact Productions

One key to ReelShort’s success is its low production cost. The average show on ReelShort costs under $300,000 to produce, as the company focuses on storytelling rather than star power. “Unlike traditional film studios that rely on celebrities to attract viewers, we invest in compelling stories,” says Jia. “Our goal is to create content that drives ‘impulse purchases’—the kind of story people can’t resist buying into.”Data-Driven Storytelling

ReelShort leverages data to refine its content. Production cycles are condensed to three months, allowing the company to quickly assess audience feedback and make improvements. “After three months, we have detailed insights—how many people paid for the content, where viewers dropped off, and why they stayed,” says Jia. “This allows us to iterate and optimize content based on real-time data.”This approach enables ReelShort to react swiftly to market demands, which Jia believes gives the company a significant advantage over traditional media platforms like Netflix. “We have the flexibility to rework stories based on audience feedback, something legacy media can’t do as efficiently.”

The Future of Entertainment

Jia envisions ReelShort becoming a platform for “professional user-generated content” (PUGC), bridging the gap between TikTok’s influencer-driven videos and Netflix’s high-budget productions. “Our goal is to provide a distribution channel for professional content creators who don’t have Hollywood budgets but have stories worth telling,” he says. “In five years, I hope ReelShort will be a go-to platform for diverse, high-quality short-form content.”While ReelShort’s model draws comparisons to failed short-form ventures like Quibi, Jia is confident his platform will thrive. “The market is constantly evolving, and we’re committed to staying ahead of it,” he notes. “Our strategy revolves around delivering engaging stories efficiently and keeping a pulse on audience preferences.”

With ReelShort’s rapid growth and data-driven approach, Jia is optimistic about the platform’s potential. “We want ReelShort to become a major entertainment hub for modern audiences, where creators can reach fans and continue to innovate,” he says.

As micro-dramas continue to gain popularity, ReelShort’s success signals a shift in the entertainment landscape, one where short-form video could rival traditional streaming services. sions, particularly in the Middle East and Asia, have also unsettled markets. Rising oil prices due to regional conflicts and uncertainty over US-China trade relations have added to investor anxiety. The ripple effects are being felt across various asset classes, with some sectors experiencing heightened volatility.

Market analysts caution that while the Trump-fueled rally highlights investor confidence in pro-business policies, it also underscores the fragility of sentiment in the face of broader economic challenges. “The market is caught between optimism about potential policy shifts and the reality of existing economic pressures,” noted one strategist.

Despite these obstacles, proponents of the rally argue that Trump’s leadership style and policy priorities could provide a long-term boost to the economy. They believe that continued deregulation and tax reforms could spur growth, particularly in manufacturing and infrastructure. However, skeptics counter that such policies may face significant hurdles in implementation, particularly in a divided Congress.

The path forward for the stock market remains uncertain, with much hinging on how quickly the Federal Reserve can balance inflation control with growth, and whether geopolitical tensions can be de-escalated. For now, investors appear to be proceeding with caution, balancing their hopes for a pro-growth environment with the challenges of navigating a complex and unpredictable global landscape.

Up next

Barclays Reshuffles APAC Investment Banking Leadership to Boost Regional Presence

July 3, 2025

3 minutes read

Elon Musk Faces Backlash Over Comments Targeting Government Employees

November 27, 2024

2 minutes read

Major Cybersecurity Concerns Highlighted in Andrew Tate Hack and Undersea Cable Incident

November 25, 2024

2 minutes read

DirecTV and Dish Network Merger Cancelled Amid Regulatory and Financial Challenges

November 22, 2024

2 minutes read

Deportation Concerns Loom Over U.S. Labor Market Amid Worker Shortages

November 21, 2024

2 minutes read

Comcast Explores Spinoff of NBCUniversal's Cable Division Amid Industry Changes

November 20, 2024

2 minutes read

Economic Concerns Arise Over Trump’s Deportation Plan Amid Grocery Price Inflation

November 19, 2024

2 minutes read

China Challenges Western Duopoly in Civil Aviation with C919 Aircraft Launch

November 17, 2024

2 minutes read

Disney’s Earnings Offer Hope for Streaming Amid Decline of Traditional TV

November 15, 2024

2 minutes read

Bluesky's User Base Doubles as Users Flee X Amid Trump Influence and Content Shifts

November 14, 2024

2 minutes read

Ringgit Opens Slightly Higher Against US Dollar Ahead of Key Inflation Data

November 13, 2024

2 minutes read

7-Eleven Owner Considers Historic $58 Billion Buyout to Go Private in Japan

November 13, 2024

2 minutes read

U.S. Regulators Investigate Engine Failures in 1.4 Million Honda Vehicles

November 12, 2024

1 minutes read

Woman Discovers Forgotten Lottery Ticket in Her Purse, Wins $1 Million

November 11, 2024

2 minutes read

How ReelShort CEO Joey Jia Used a Chinese Trend to Disrupt the U.S. Entertainment Industry

November 11, 2024

8 minutes read