Barclays Reshuffles APAC Investment Banking Leadership to Boost Regional Presence

July 3, 2025 at 6:40 AM

3 minutes read

Barclays announced a significant reshuffle of its Asia-Pacific (APAC) investment banking leadership as part of its strategy to expand its footprint and deepen client engagement in the region. The move comes amid intensifying competition from global and regional banks and a surge in deal activity across Asia.

🌏 Key Appointments

- John Chang is appointed as Head of Investment Banking for APAC.

- Emily Wong becomes Vice Chair of Investment Banking APAC and will also oversee key client relationships.

- Both report directly to Paul Compton, Global Head of Investment Banking, and Jaideep Khanna, Head of Barclays APAC.

🚀 Strategic Goals

The leadership shake-up underscores Barclays’ intention to grow its advisory, equity capital markets (ECM), and debt capital markets (DCM) businesses in Asia. The bank is focusing on sectors such as technology, healthcare, and sustainability, which continue to generate strong demand for capital and M&A advisory in the region.

📈 Regional Momentum

Over the past year, Asia has seen robust deal flow, particularly in India and Southeast Asia, areas where Barclays has already been increasing its presence. The firm aims to leverage its global capabilities while tailoring services to local market dynamics. The bank has also been hiring aggressively in ECM and DCM teams to keep pace with client needs.

🔮 Outlook

Barclays expects the new leadership team to help deliver stronger revenue growth and deepen partnerships with corporate and institutional clients. This realignment is seen as a step toward making Barclays more competitive against U.S. and Chinese rivals in one of the world’s fastest-growing financial markets.

Up next

Elon Musk Faces Backlash Over Comments Targeting Government Employees

November 27, 2024

2 minutes read

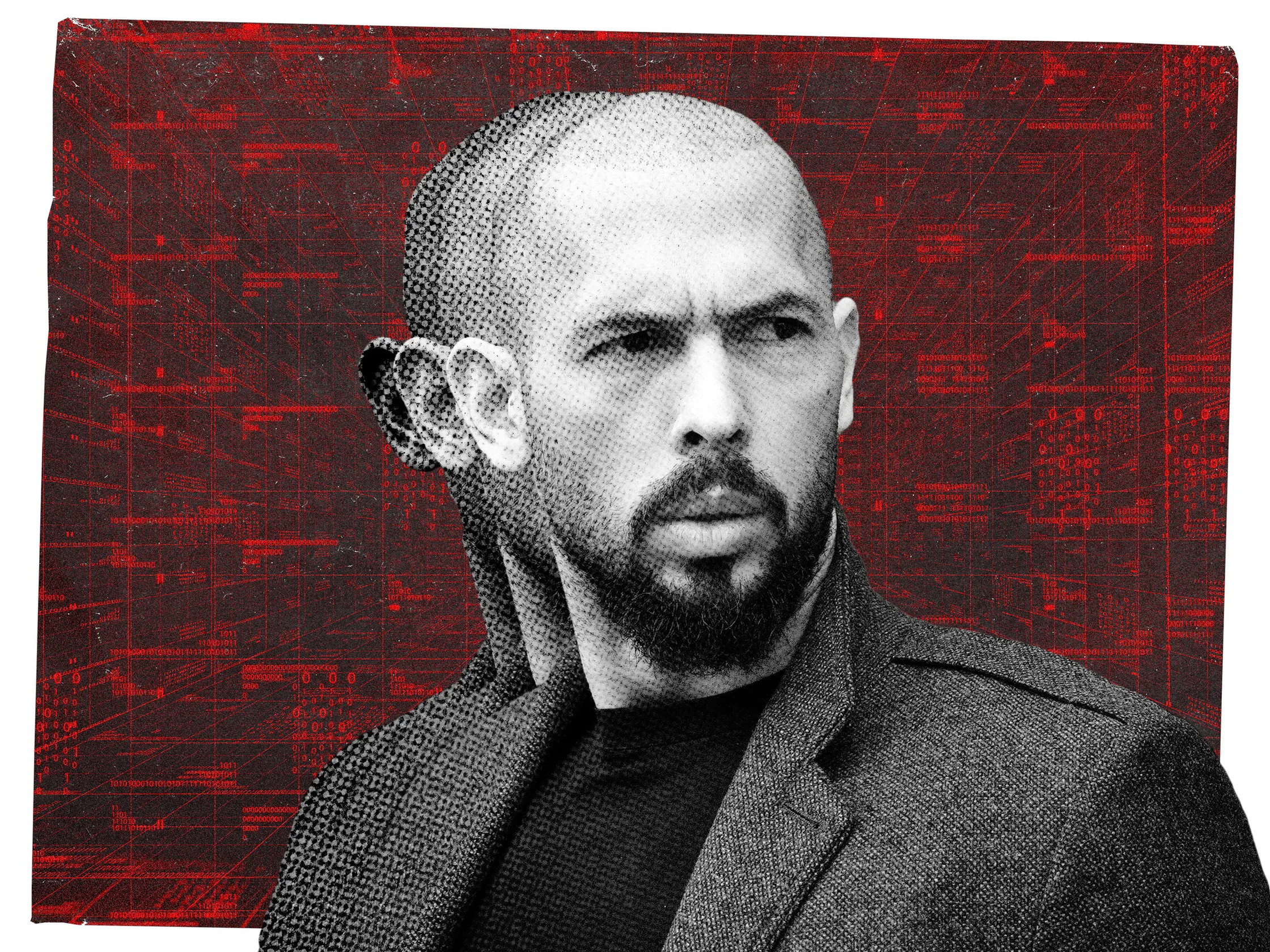

Major Cybersecurity Concerns Highlighted in Andrew Tate Hack and Undersea Cable Incident

November 25, 2024

2 minutes read

DirecTV and Dish Network Merger Cancelled Amid Regulatory and Financial Challenges

November 22, 2024

2 minutes read

Deportation Concerns Loom Over U.S. Labor Market Amid Worker Shortages

November 21, 2024

2 minutes read

Comcast Explores Spinoff of NBCUniversal's Cable Division Amid Industry Changes

November 20, 2024

2 minutes read

Economic Concerns Arise Over Trump’s Deportation Plan Amid Grocery Price Inflation

November 19, 2024

2 minutes read

China Challenges Western Duopoly in Civil Aviation with C919 Aircraft Launch

November 17, 2024

2 minutes read

Disney’s Earnings Offer Hope for Streaming Amid Decline of Traditional TV

November 15, 2024

2 minutes read

Bluesky's User Base Doubles as Users Flee X Amid Trump Influence and Content Shifts

November 14, 2024

2 minutes read

Ringgit Opens Slightly Higher Against US Dollar Ahead of Key Inflation Data

November 13, 2024

2 minutes read

7-Eleven Owner Considers Historic $58 Billion Buyout to Go Private in Japan

November 13, 2024

2 minutes read

U.S. Regulators Investigate Engine Failures in 1.4 Million Honda Vehicles

November 12, 2024

1 minutes read

Woman Discovers Forgotten Lottery Ticket in Her Purse, Wins $1 Million

November 11, 2024

2 minutes read

How ReelShort CEO Joey Jia Used a Chinese Trend to Disrupt the U.S. Entertainment Industry

November 11, 2024

8 minutes read