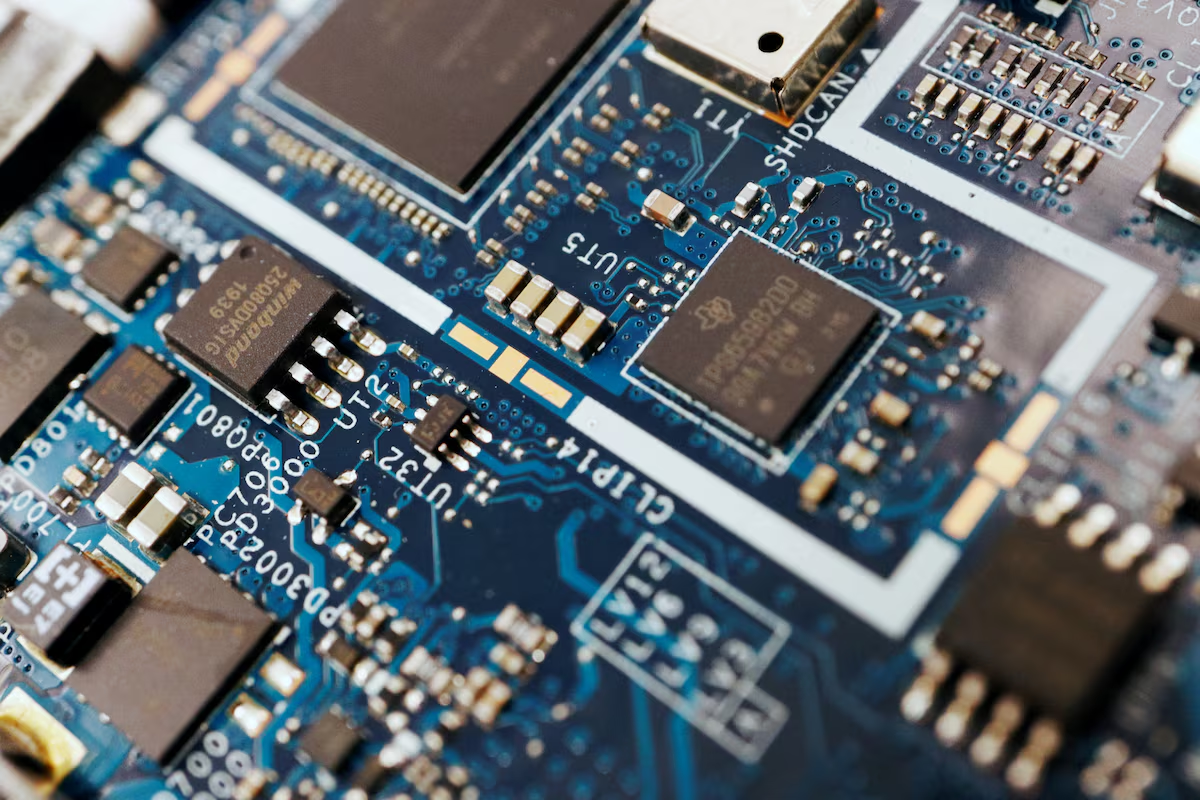

Chinese AI Chip Startups Launch $1.7 B IPOs Ahead of U.S. Export Curbs

July 1, 2025 at 5:49 AM

3 minutes read

Chinese AI‑chip specialists Moore Threads (Beijing) and MetaX (Shanghai) filed for IPOs on Shanghai’s STAR Market on July 1, targeting a combined ¥12 billion (~$1.65 billion)—¥8 billion from Moore Threads and ¥3.9 billion from MetaX.

🧠 Strategic Timing Amid U.S. Sanctions

With the U.S. imposing restrictions on high-end GPU exports—including Nvidia’s H20 and limiting access to cutting-edge foundries like TSMC—both firms see opportunities in accelerating China’s push for domestic GPU capabilities. Both were added to the U.S. Entity List (Moore Threads in late 2023), restricting foreign collaboration. Despite flagging U.S. measures as a risk, they emphasize the sanctions will drive local demand.

📉 Heavy Investments, Deep Losses

Both startups reported significant losses due to aggressive R&D spending:

- Moore Threads recorded a ¥1.49 billion loss in 2024 (¥438 million in sales).

- MetaX saw a ¥1.4 billion loss on ¥743 million revenue. Founded in 2020 by ex-Nvidia (Moore Threads) and ex‑AMD (MetaX) execs, these firms are seen as front-runners in China’s domestic GPU race.

🌐 Broader Chip Self‑Sufficiency Push

China's strategic push for semiconductor independence includes backing from competitors like Huawei, Cambricon, Enflame, and Hygon. Financial backing through public markets is critical for scaling and sustaining R&D. Omdia analyst He Hui notes IPO proceeds are essential to reach economies of scale and enhance competitiveness.

🔮 What’s Next

- Listing & expansion: Both firms aim to use IPO capital to expand production and accelerate innovation domestically.

- Competitive landscape: They’ll face fierce competition from both domestic giants and each other.

- Policy-driven growth: With U.S. export restrictions likely to tighten, China’s GPU ecosystem stands to gain momentum—and international influence.

Up next

Australian PM Albanese Criticizes Elon Musk’s Pushback on Social Media Regulations

December 1, 2024

2 minutes read

Meta Fined $428 Million in Europe Over Facebook Marketplace Antitrust Violations

November 30, 2024

2 minutes read

China’s Huawei Launches Harmony OS-Powered Mate 70 Amid Growing Global Ambitions

November 28, 2024

2 minutes read

Google and Meta Call on Australia to Delay Social Media Ban for Children

November 26, 2024

5 minutes read

TikTok CEO Reportedly Sought Elon Musk’s Advice Amid Trump Administration’s Pressure

November 24, 2024

4 minutes read

AI Chip Leader Nvidia Forecasts Fourth-Quarter Revenue Above Estimates

November 22, 2024

2 minutes read

U.S. Watchdog Finalizes Rules to Supervise Big Tech Payments and Digital Wallets

November 21, 2024

2 minutes read

Entrepreneurs Look to Start-Up Show Amid Optimism Over Easing Funding Bottlenecks

November 20, 2024

3 minutes read

Sony in Talks to Acquire Media Powerhouse Behind Elden Ring, Sources Reveal

November 19, 2024

2 minutes read

Nvidia's New AI Chips Reportedly Face Overheating Challenges in Data Centers

November 18, 2024

2 minutes read

Netflix Experiences Widespread Outage, Thousands of Users Affected in the U.S.

November 17, 2024

2 minutes read

Amazon Faces Scrutiny from House Committee Over Controversial TikTok Partnership

November 15, 2024

2 minutes read

South Korean Researchers Develop 'Morphing' Wheels That Could Revolutionize Wheelchairs and Robots

November 14, 2024

2 minutes read

Microsoft President Warns the West Not to Underestimate China’s Tech Advancements

November 13, 2024

2 minutes read

SoftBank First to Receive Nvidia’s New AI Chips for Supercomputer Development

November 13, 2024

1 minute read

Unbabel CEO Predicts AI Will Replace Humans in Translation Within Three Years as It Launches New AI-Powered App

November 13, 2024

2 minutes read

Singapore’s Capital C Secures Pre-Series A Funding to Launch Super App for Southeast Asia

November 12, 2024

1 minutes read

Next level drone control with just swipe of fingers. Researchers from China performs video demonstration

November 11, 2024

3 minutes read

Google and Meta Block Political Ads to Curb Misinformation, but Experts Warn It May Be Too Late

November 11, 2024

5 minutes read