Ethereum Price Dips Amid Market Volatility, Holds Above $3,200

November 17, 2024 at 1:00 PM

2 minutes read

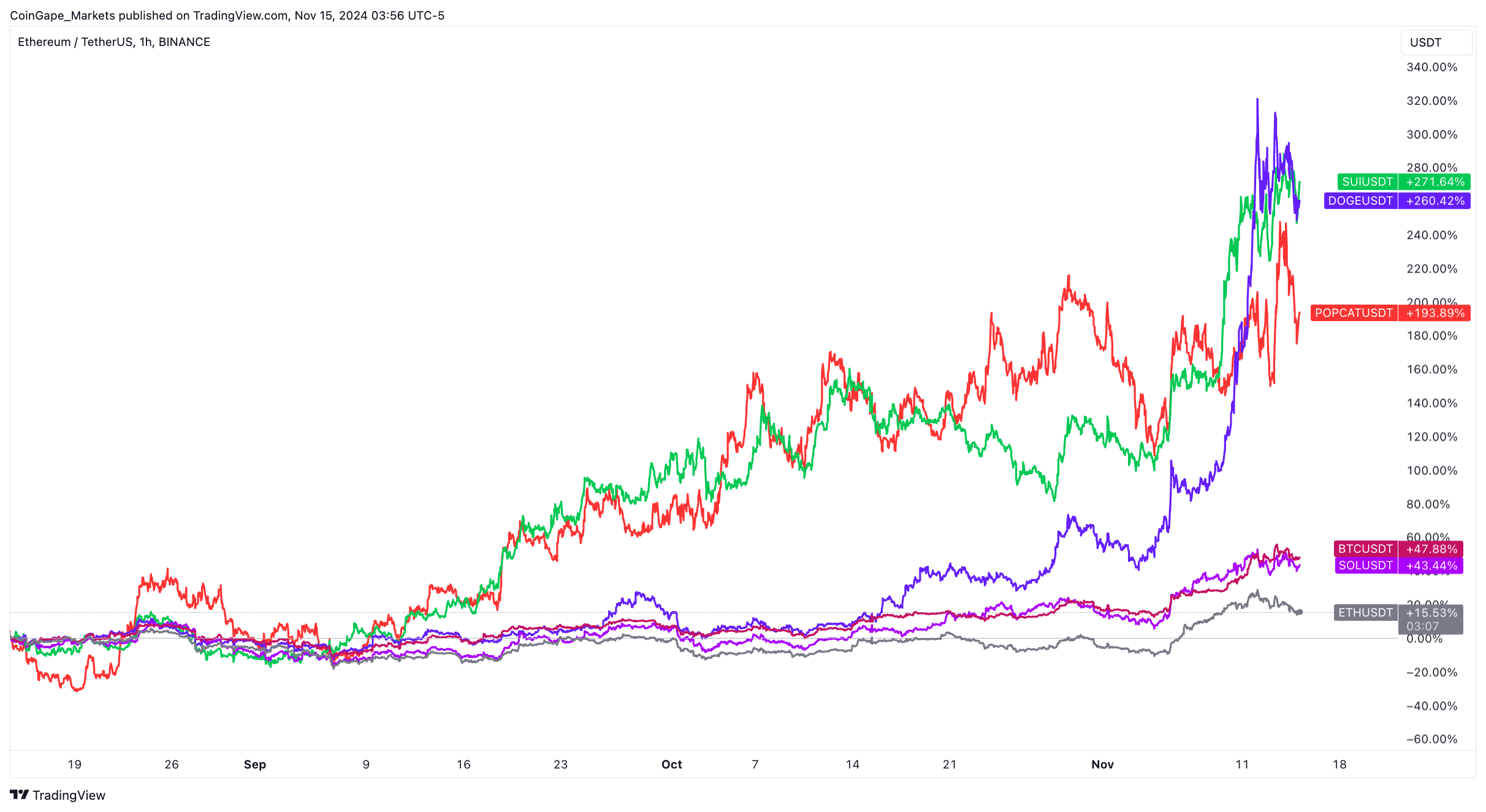

Ethereum (ETH), the world’s second-largest cryptocurrency, experienced a slight dip in its price on Thursday, trading at $3,212 after dropping 2.5% in the last 24 hours. Despite the downturn, Ethereum has managed to maintain its position above the $3,200 mark, signaling resilience amid broader market volatility.

The crypto market remains highly dynamic, with Bitcoin’s recent price fluctuations influencing Ethereum and other altcoins. Analysts point to a combination of profit-taking, regulatory developments, and macroeconomic uncertainties as contributing factors to the recent dip. The Fear and Greed Index for the crypto market remains in the “Greed” zone, reflecting investor optimism despite short-term setbacks.

Ethereum’s performance continues to be bolstered by its robust ecosystem, which includes decentralized finance (DeFi) projects, non-fungible tokens (NFTs), and its transition to the proof-of-stake (PoS) consensus mechanism following the Merge. Market analysts predict Ethereum could see a rebound if Bitcoin stabilizes and institutional interest in digital assets remains strong.

However, short-term challenges persist, with traders closely watching for upcoming economic data and Federal Reserve decisions on interest rates, which could impact market sentiment across crypto and traditional financial markets.

Up next

Crypto Market Today: Ethereum, SUI, XRP, Pi Network React to Market Trends

July 3, 2025

3 minutes read

Ethereum Classic’s Golden Cross Sparks Optimism for a Potential Rally to $40

December 1, 2024

2 minutes read

Shiba Inu Could Surge 75% if Key Support Level Holds, Analyst Predicts

November 30, 2024

4 minutes read

Tornado Cash Ruling: A Boost for Ethereum and DeFi, According to 10X Research

November 28, 2024

2 minutes read

XRP Surges After Ripple Announces Investment in Rebranded Bitwise Fund

November 27, 2024

2 minutes read

Dogecoin, Solana Face Double-Digit Losses Amidst Crypto Market Slowdown

November 26, 2024

2 minutes read

XRP Breaks Out After 4 Days of Stability, Dogecoin Shows Double-Top Signs, PEPE Struggles

November 21, 2024

2 minutes read

Cryptocurrency Prices Surge: Bitcoin Hits $91K, HBAR and XTZ Lead with 40% Gains

November 19, 2024

4 minutes read

Dogecoin Price Analysis: Elliott Wave Patterns Hint at Potential Movement

November 18, 2024

3 minutes read

Investigative Author Zeke Faux Explores Dark Side of Crypto in New Book

November 15, 2024

2 minutes read

Bitcoin Briefly Surges Past $93,000 on Trump’s Pro-Crypto Agenda and Fed Rate Speculation

November 14, 2024

1 minutes read

Crypto Price Today: Bitcoin and Ether See Minor Losses Amidst Market Volatility

November 13, 2024

2 minutes read

Bitcoin Hits Record High Near $90K, Dogecoin Surges on Trump-Driven Hype

November 12, 2024

1 minutes read