Cryptocurrency Prices Surge: Bitcoin Hits $91K, HBAR and XTZ Lead with 40% Gains

November 19, 2024 at 10:00 AM

4 minutes read

The cryptocurrency market is experiencing a significant upswing, with Bitcoin (BTC) leading the charge by surging to an unprecedented $91,000, marking its highest value to date. Altcoins such as Hedera (HBAR) and Tezos (XTZ) are also making waves, recording gains of over 40% in the last 24 hours.

Bitcoin’s Historic Rally

Bitcoin’s meteoric rise to $91,000 has solidified its dominance in the cryptocurrency market. The surge is attributed to a combination of factors, including increased institutional interest, macroeconomic conditions, and renewed optimism about its long-term potential as a hedge against inflation. Analysts believe the recent uptick is a continuation of a broader bullish trend driven by growing adoption and diminishing supply due to Bitcoin's deflationary nature.

“Bitcoin’s rally signals strong market confidence as investors pile into the asset amid global economic uncertainties,” said a market strategist.

HBAR and XTZ Steal the Show

While Bitcoin dominates headlines, altcoins are delivering even more dramatic returns. Hedera (HBAR) and Tezos (XTZ) have emerged as the top performers, both gaining over 40% in value.

Hedera's growth is linked to increasing enterprise adoption of its blockchain technology, which offers fast and scalable solutions for decentralized applications. Meanwhile, Tezos has benefited from new partnerships and developments within its ecosystem, including NFT and DeFi integrations that have captured investor attention.

“Altcoins like HBAR and XTZ are benefiting from ecosystem expansions and broader market sentiment. These gains reflect growing diversification within the crypto space,” noted a crypto analyst.

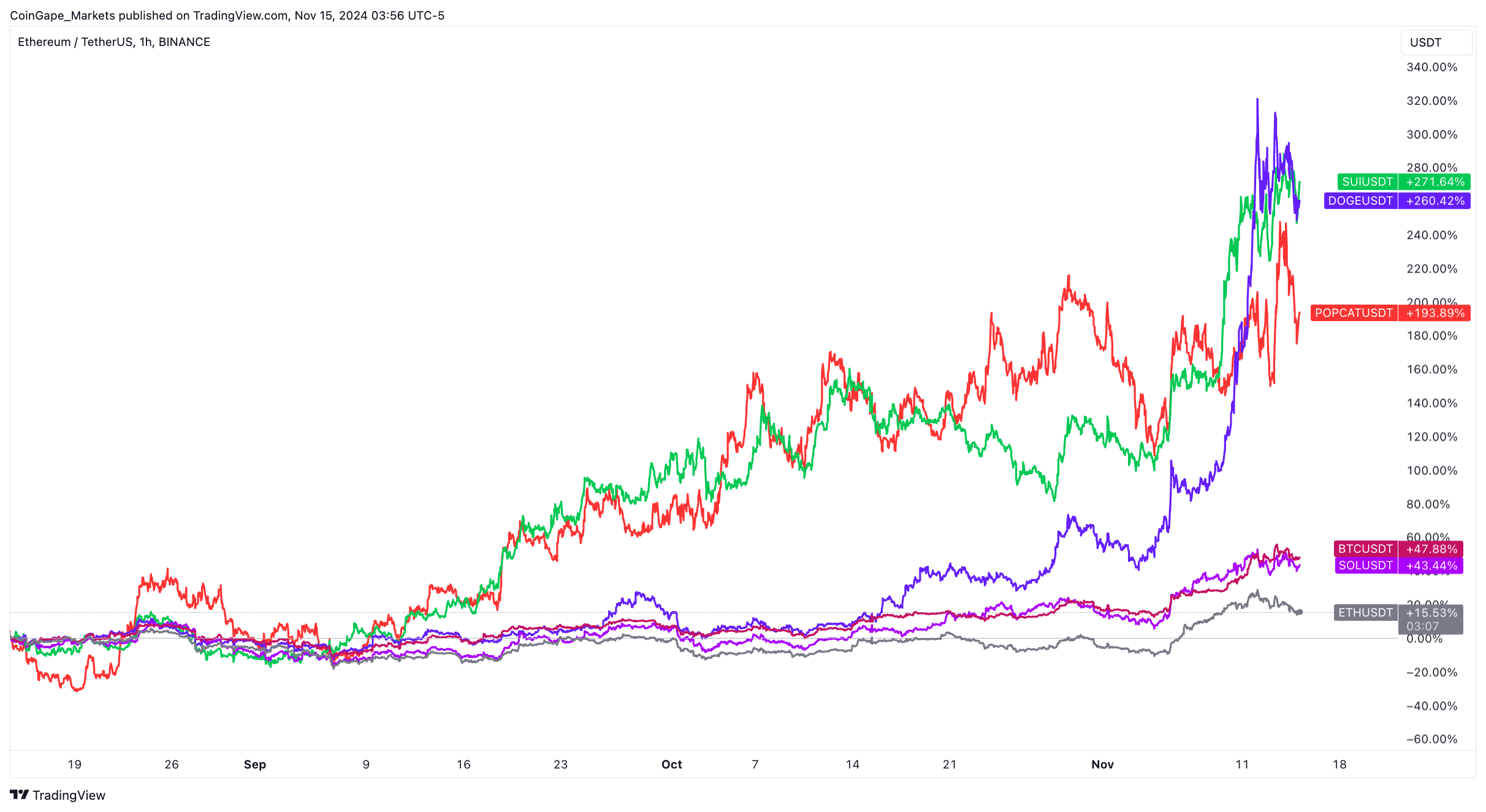

Broader Market Trends

The broader cryptocurrency market has seen a wave of positive momentum, with Ethereum (ETH), Binance Coin (BNB), and Cardano (ADA) also recording notable gains. Total market capitalization has surged, crossing the $3.5 trillion mark, underscoring renewed investor confidence.

Key drivers of the rally include:

Looking Ahead

As Bitcoin and altcoins continue their upward trajectories, the market is abuzz with speculation about how high prices could climb in the short term. Many analysts believe Bitcoin could breach the $100,000 milestone if current conditions persist, while altcoins with strong fundamentals are expected to deliver sustained growth.

With cryptocurrencies gaining mainstream traction and innovations driving adoption, the future of the digital asset market looks brighter than ever. However, investors are reminded to stay informed and manage their portfolios carefully in this dynamic environment.

Up next

Crypto Market Today: Ethereum, SUI, XRP, Pi Network React to Market Trends

July 3, 2025

3 minutes read

Ethereum Classic’s Golden Cross Sparks Optimism for a Potential Rally to $40

December 1, 2024

2 minutes read

Shiba Inu Could Surge 75% if Key Support Level Holds, Analyst Predicts

November 30, 2024

4 minutes read

Tornado Cash Ruling: A Boost for Ethereum and DeFi, According to 10X Research

November 28, 2024

2 minutes read

XRP Surges After Ripple Announces Investment in Rebranded Bitwise Fund

November 27, 2024

2 minutes read

Dogecoin, Solana Face Double-Digit Losses Amidst Crypto Market Slowdown

November 26, 2024

2 minutes read

XRP Breaks Out After 4 Days of Stability, Dogecoin Shows Double-Top Signs, PEPE Struggles

November 21, 2024

2 minutes read

Dogecoin Price Analysis: Elliott Wave Patterns Hint at Potential Movement

November 18, 2024

3 minutes read

Investigative Author Zeke Faux Explores Dark Side of Crypto in New Book

November 15, 2024

2 minutes read

Bitcoin Briefly Surges Past $93,000 on Trump’s Pro-Crypto Agenda and Fed Rate Speculation

November 14, 2024

1 minutes read

Crypto Price Today: Bitcoin and Ether See Minor Losses Amidst Market Volatility

November 13, 2024

2 minutes read

Bitcoin Hits Record High Near $90K, Dogecoin Surges on Trump-Driven Hype

November 12, 2024

1 minutes read