Bitcoin Briefly Surges Past $93,000 on Trump’s Pro-Crypto Agenda and Fed Rate Speculation

November 14, 2024 at 12:00 PM

1 minutes read

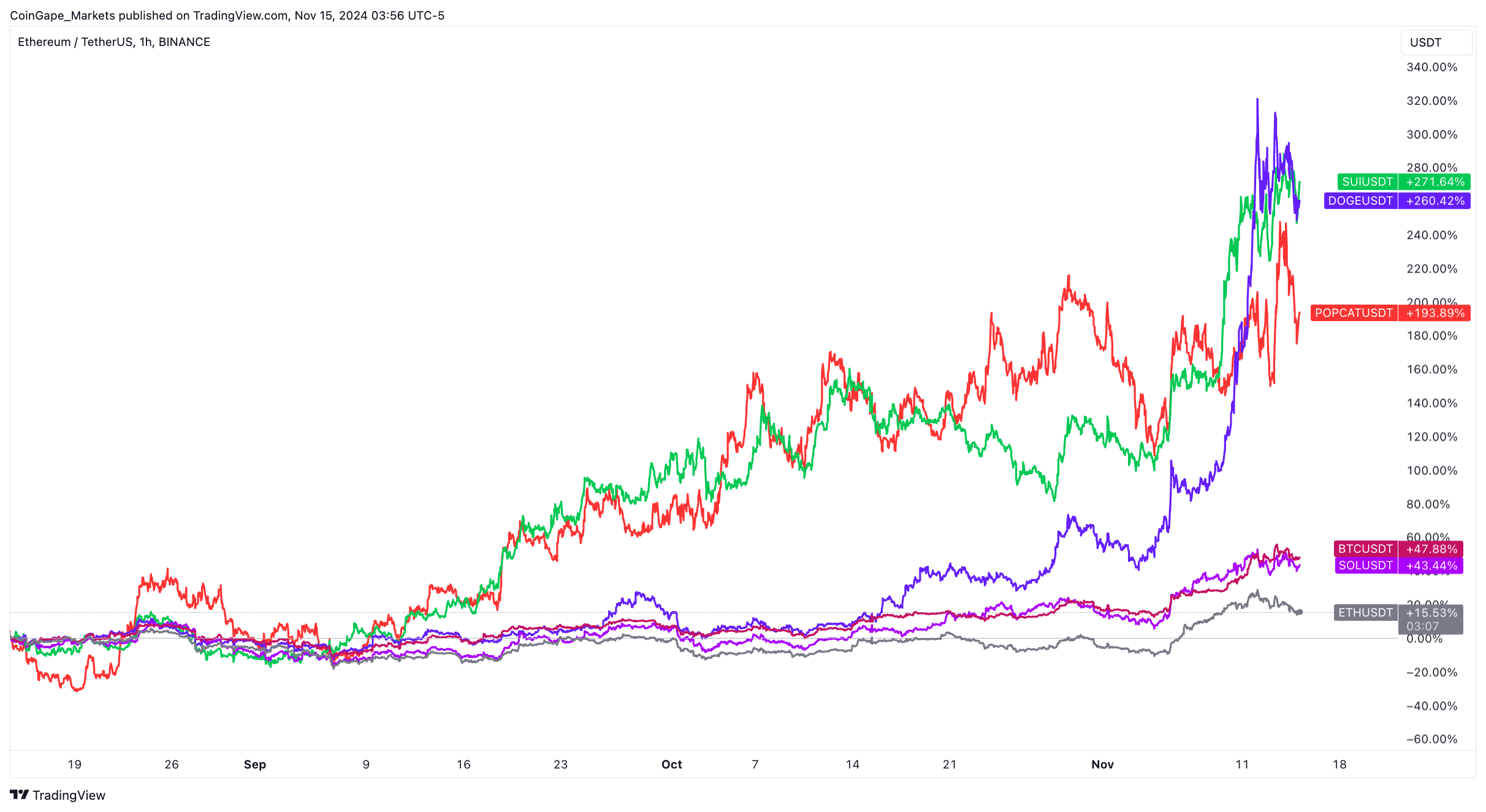

Bitcoin briefly reached an all-time high of $93,462 on Thursday, fueled by expectations of further interest rate cuts by the Federal Reserve and President-elect Donald Trump’s supportive stance on cryptocurrency. The digital asset, which has surged by 33% since Trump’s election victory on November 5, experienced a quick pullback, trading at $89,974 by mid-morning in Singapore.

Speculators are watching closely to determine whether Trump’s pro-crypto agenda will drive Bitcoin further toward the anticipated $100,000 mark or if profit-taking will dampen its upward momentum. “After such an extended move, it’s reasonable to expect a mix of opinions and increased two-way flows,” commented Chris Weston, head of research at Pepperstone Group. Despite some volatility, Weston noted that Bitcoin’s trend remains bullish “for now.”

Market sentiment was further impacted by U.S. inflation data released on Wednesday, which met analyst expectations and led traders to bet on another quarter-point rate cut from the Fed in December. Trump’s promise to create a crypto-friendly regulatory environment, establish a strategic Bitcoin stockpile, and position the U.S. as a global crypto hub has also bolstered investor optimism.

While crypto advocates are enthusiastic, some industry leaders remain cautious. Billionaire Michael Novogratz, founder of Galaxy Digital, told Bloomberg Television that while a U.S. Bitcoin reserve is unlikely, if it materializes, Bitcoin could potentially reach $500,000. The ongoing rally has also driven record trading volumes and inflows in U.S. Bitcoin exchange-traded funds, with companies like MicroStrategy benefiting from the crypto boom.

Up next

Crypto Market Today: Ethereum, SUI, XRP, Pi Network React to Market Trends

July 3, 2025

3 minutes read

Ethereum Classic’s Golden Cross Sparks Optimism for a Potential Rally to $40

December 1, 2024

2 minutes read

Shiba Inu Could Surge 75% if Key Support Level Holds, Analyst Predicts

November 30, 2024

4 minutes read

Tornado Cash Ruling: A Boost for Ethereum and DeFi, According to 10X Research

November 28, 2024

2 minutes read

XRP Surges After Ripple Announces Investment in Rebranded Bitwise Fund

November 27, 2024

2 minutes read

Dogecoin, Solana Face Double-Digit Losses Amidst Crypto Market Slowdown

November 26, 2024

2 minutes read

XRP Breaks Out After 4 Days of Stability, Dogecoin Shows Double-Top Signs, PEPE Struggles

November 21, 2024

2 minutes read

Cryptocurrency Prices Surge: Bitcoin Hits $91K, HBAR and XTZ Lead with 40% Gains

November 19, 2024

4 minutes read

Dogecoin Price Analysis: Elliott Wave Patterns Hint at Potential Movement

November 18, 2024

3 minutes read

Investigative Author Zeke Faux Explores Dark Side of Crypto in New Book

November 15, 2024

2 minutes read

Crypto Price Today: Bitcoin and Ether See Minor Losses Amidst Market Volatility

November 13, 2024

2 minutes read

Bitcoin Hits Record High Near $90K, Dogecoin Surges on Trump-Driven Hype

November 12, 2024

1 minutes read